In just five years, Shayne Coplan, the Founder & CEO of Polymarket, turned what was once considered a “risky” idea in the crypto space into a $9 billion company, taking prediction markets from the fringes of DeFi to the heart of Wall Street.

At 27 years old, Coplan, the founder of blockchain-based prediction platform Polymarket, became the youngest self-made billionaire in the world following a $2 billion investment from the Intercontinental Exchange (ICE)—the parent company of the New York Stock Exchange.

What began as a bold idea now stands as a thriving $9 billion platform. In the midst of the chaos of 2020, Coplan transformed his vision of decentralized prediction markets into a key player on Wall Street. Polymarket is a testament to the power of trust, data, and truth in shaping a new asset class of the 21st century.

The Turbulent Beginning

In March 2020, as the pandemic paralyzed New York, a 21-year-old dropout, Shayne Coplan, sat in his small Upper West Side apartment, coding the first lines of his project, which he believed could redefine “truth.”

Having dropped out of New York University (NYU) because he believed the world outside moved faster than the classroom could teach, Coplan was already involved with Ethereum at 16 and had become captivated by the concept of decentralized finance. But what truly fascinated him was “prediction markets”—platforms where people bet on the future, and money filters out the truth.

Amid the pandemic’s chaos, Coplan realized that “the rarest thing was not the vaccine, but the truth.” In June 2020, he launched Polymarket, a decentralized prediction platform where users could bet with USDC on real-world events—ranging from COVID cases to presidential elections. Each option was tokenized, and their prices reflected the crowd’s belief.

Initially, the project was a small group of engineers working remotely, with no venture capital or marketing. Yet within a year, Polymarket surpassed $1 billion in transactions, becoming the world’s largest prediction platform. Coplan didn’t see it as a betting platform but as “a machine to find the truth through economic incentives.”

Believing “trust can also be priced,” this dropout transformed an academic idea into a global social data platform, setting the stage for his path to becoming the youngest self-made billionaire in the world.

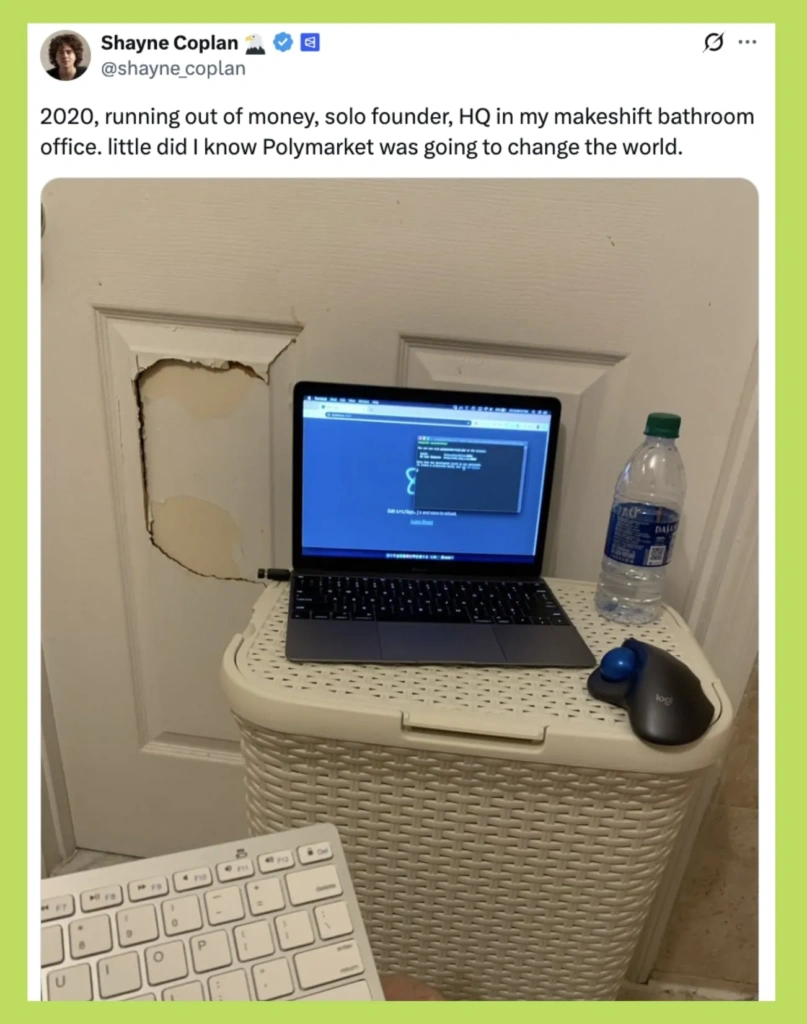

“The first office” of Polymarket.

Polymarket – The Market of Truth

Polymarket quickly became a sensation. It wasn’t just a place for “fun betting”; Shayne Coplan’s platform turned trust into quantifiable data. Users traded “YES” and “NO” tokens in USDC, with their prices fluctuating according to supply and demand, reflecting the crowd’s probability belief in an event occurring. Once the event concluded, the correct token paid out $1, and the incorrect token became worthless.

It was a market operating on trust, but also the most transparent social data system ever created. Every transaction was recorded on the blockchain, immutable—creating what Coplan called the “liquidity of truth.”

Polymarket exploded during the 2024 U.S. presidential election, with over $3 billion wagered on the results of each state. While traditional polls wavered, Polymarket displayed superior accuracy, becoming a data source followed daily by journalists, hedge funds, and even politicians.

From there, Polymarket wasn’t just a DeFi platform; it became the new infrastructure for human trust. Financial institutions began extracting data from Polymarket to analyze risks and social behavior, marking the shift of “prediction markets” from the crypto periphery to the heart of Wall Street.

However, with fame came bigger challenges, as Polymarket faced the limitations of legal and political power.

Dark Days with the CFTC, FBI, and a Crisis of Trust

In 2022, as Polymarket was experiencing rapid growth, the Commodity Futures Trading Commission (CFTC) unexpectedly intervened. The agency accused Shayne Coplan’s platform of operating as an unlicensed derivatives exchange and fined the company $1.4 million. Polymarket had to block U.S. users, a heavy blow for a young startup only two years old.

“One day, you think you’re building a tool for truth, the next day, you’re seen as running a casino,” Coplan recalled. Despite this, he didn’t stop. Polymarket expanded internationally, maintained its loyal community, and began working on ways to legalize its operations instead of clashing with the authorities.

In November 2024, just one week after the U.S. presidential election, the FBI raided Coplan’s Manhattan apartment. The agency suspected that Polymarket allowed illegal U.S. bets, potentially influencing political public opinion.

The news of the raid spread widely, turning Coplan from a young founder into a symbol of resistance in the crypto world. He didn’t respond to the media but posted a single line on X: “They can’t stop the truth.” For many, it was a declaration from someone who believed in his idea so strongly that he was willing to endure any scrutiny.

From CFTC Investigation to Greenlight in the U.S. Market

Six months later, both the U.S. Department of Justice and the CFTC closed their investigations without further prosecution. Almost simultaneously, Polymarket announced the acquisition of QCEX, an exchange licensed by the CFTC, paving the way for full legalization in the U.S.

Analysts called this a “dramatic 180-degree turn”: from being fined to holding a license in three years. “It wasn’t just a legal victory,” Coplan said, “it was proof that a right idea can survive any system, if you persevere long enough.”

A Historic Partnership Between Polymarket and the New York Stock Exchange

As the crisis subsided, Polymarket entered a new chapter. Now, the financial institutions that once doubted them were looking to partner. In October 2025, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, invested $2 billion in Polymarket, valuing the company at $9 billion and making Coplan the youngest self-made billionaire in the world at age 27.

“Polymarket used to be seen as an illegal game,” he said. “Now it’s a data source for the very organizations that once doubted us.” For Shayne Coplan, the crisis wasn’t a failure, but a test to prove that with enough trust and time, perseverance could ultimately prevail.

When Coplan announced the $2 billion deal with ICE, he not only revealed a historic partnership between DeFi and Wall Street but also unexpectedly shared two previously undisclosed funding rounds—silent milestones that took Polymarket from an apartment startup to today’s $9 billion valuation.

In early 2025, Peter Thiel’s Founders Fund led a $150 million funding round, valuing Polymarket at $1.2 billion. Joining the round were elite investors from both Silicon Valley and Wall Street: Ribbit, Valor, Point72 Ventures, SV Angel, 1789, 1confirmation, Blockchain Capital, Coinbase, Dragonfly, along with angel investors like Ari Emanuel, Glenn Dubin, Guy Oseary, Naval Ravikant, Rick Rubin, Ron Conway, Travis Kalanick, and many other prominent figures.

A year earlier, in 2024, right before the U.S. presidential election, Blockchain Capital had led a $55 million funding round, valuing the company at $350 million, with participation from Founders Fund, 1789, Abstract, ParaFi, SV Angel, and investors from various fields, including Anthony Kiedis (Red Hot Chili Peppers), Dylan Field (Figma), Mark Pincus (Zynga), Saquon Barkley (NFL), among others.

These investments not only brought in capital but also connected Polymarket with the global elite of both finance and creativity. The partnership with ICE was a clear demonstration of that connection—Polymarket went from being seen as an illegal betting platform to becoming part of Wall Street’s financial data infrastructure.

Shayne Coplan – Willpower That Makes the Right Idea Persist

For Coplan, this wasn’t just a financial victory; it was proof of a once-dismissed idea. “The truth may be delayed, but it can’t be extinguished,” he said in an interview with Bloomberg. As ICE’s strategic partner, Polymarket is expanding into economic prediction, AI, energy, and global politics, turning crowd data into the new trading signals of the 21st century.

At 27, Coplan still works late into the night, preferring silence over the spotlight. From a college dropout during the pandemic, once fined by the CFTC and raided by the FBI, Coplan has joined the ranks of those shaping the future of global finance. Not through marketing strategies, but with unwavering belief: that truth, when made transparent and fairly priced, is the most sustainable asset humanity has ever created.

A Vision That Redefines DeFi

That vision is now redefining DeFi: no longer a utopian dream of absolute financial freedom but a transparent network where data, trust, and truth operate within the same system. At the center of that network stands Polymarket, and its young founder believes this is just the beginning.

From a small apartment during the pandemic to the pinnacle of global finance, Shayne Coplan’s journey proves that even in the most chaotic times, truth has value—and sometimes, that value is worth billions of dollars.