Ondo Finance is emerging as the most comprehensive RWA platform, offering on-chain bonds, deposits, and liquidity funds. This article analyzes its model, products, cash flows, and role in the rapidly expanding RWA market.

For nearly a decade, DeFi grew on a closed-loop model: liquidity created and rotated internally through lending, AMMs, yield farming, and complex leverage structures. Yields mainly came from newly issued tokens, meaning there was no external cash flow required, just an assumption that new participants would buy the risk from the previous ones.

This model thrived in the post-financial crisis era when capital was cheap and soared during the 2020–2021 boom, when global interest rates were near zero, and risks were undervalued. Despite its structural risks, on-chain yields were more attractive than idle options in traditional markets.

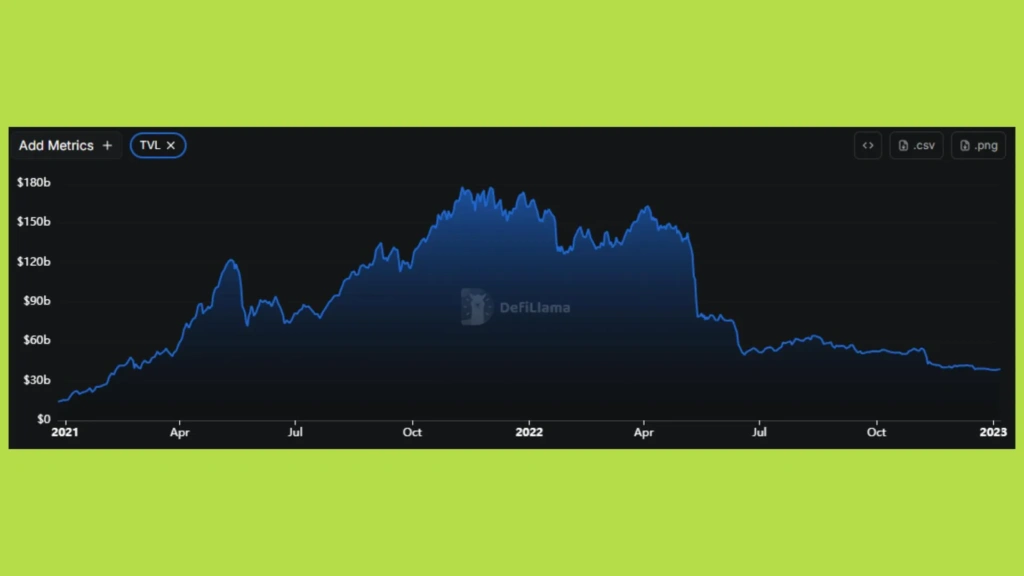

However, since 2022, when the Fed started tightening, the limits of this model became clear. Short-term U.S. Treasury yields surpassed 4–5%, causing most on-chain yields to lose their appeal after adjusting for risk. DeFi liquidity contracted sharply, with TVL falling over 70% from its peak, showing that speculative capital retreated as the risk premium became less appealing.

Tokenization and RWA: The Arrival of Real-World Capital

With capital no longer cheap and confidence in DeFi waning, tokenization of real-world assets (RWA) emerged as the natural next step: bringing real-world yields, which are already priced and widely accepted, onto the blockchain. RWA doesn’t aim to replace TradFi; rather, it integrates mature financial components into a flexible and programmable infrastructure layer.

Market data shows a clear shift: at the start of 2023, RWA on-chain was just about $1.5 billion, still experimental. Less than two years later, it surpassed $10 billion with quarterly growth exceeding 30%, outpacing every remaining DeFi native segment after the 2022 cycle. To date, tokenized assets have exceeded $18 billion (rwa.xyz), marking a roughly 1200% increase with annual growth rates reaching triple digits.

US Treasuries on-chain: The Foundation of RWA Growth

What stands out is not just the growth rate, but the structure of the capital flows. Instead of flowing into real estate or complex long-term assets as initially expected, much of the RWA capital is focused on tokenized US Treasuries—a simple, highly liquid, and low-risk asset. By the end of 2025, this asset class is expected to account for nearly 50% of the RWA market, totaling around $9 billion.

This reflects a maturation in on-chain investor behavior: during the rebuild phase, the market prioritizes stability and predictability, not innovation for the sake of innovation. DeFi now needs a base yield standard to support the entire ecosystem, from stablecoins to lending and more complex financial products.

Ondo Finance’s Role in RWA

Ondo Finance has emerged at this crucial juncture. While not the first project to tokenize assets, Ondo stands out by understanding that the core challenge lies not in technology, but in packaging the product to meet demand, comply with regulations, and efficiently distribute yields to on-chain users.

Unlike many RWA projects that began with tokenizing real-world assets, Ondo initially launched as a pure DeFi protocol focused on yield strategies and Liquidity-as-a-Service, relying heavily on internal liquidity and the market’s need for high yields. The liquidity crash of 2022 became a pivotal moment, signaling that optimizing traditional DeFi could only maintain momentum but wouldn’t generate sustainable growth.

The pivot to RWA was a complete break from the old model. Ondo restructured its products, customer base, and role in the ecosystem, transitioning from a DeFi protocol to a bridge layer where traditional assets are standardized, tokenized, and distributed efficiently on the blockchain.

OUSG: The Foundation for Ondo’s RWA Flywheel

OUSG is not just Ondo’s first successful product; it’s the foundation for the entire RWA strategy. While DeFi struggled with a lack of yield standards, OUSG emerged as a low-risk on-chain yield source, acting as the “base asset” to build more complex products like USDY, Flux Finance, Ondo Global Markets, and Ondo Chain—becoming the focal point of Ondo’s growth flywheel.

In the context of 2023—when DeFi was recovering from the Terra and FTX collapses and unsustainable yield models—stablecoin yields on platforms like Aave, Compound, and Curve dropped to 1–2%, while the Fed raised interest rates above 5%, causing risk-free yields in TradFi to surpass on-chain yields for the first time.

This gap presented an opportunity for OUSG: instead of creating yield through leverage or complex structures, Ondo directly brought U.S. Treasury yields—the safest yield benchmark globally—onto the blockchain.

OUSG’s Structure and Yield Mechanism

OUSG is a Qualified-Access Product, available only to wealthy individuals and institutions, requiring strict KYC. Individuals must have a net worth of at least $5 million, and organizations must have at least $25 million in assets. This limited access ensures near-total regulatory compliance, though it limits retail penetration speed. This trade-off was a strategic decision: Ondo opted to build a clean platform to attract institutional capital rather than sacrifice compliance for short-term growth.

Fund of Funds: Leveraging TradFi Giants

Rather than buying and managing U.S. Treasuries directly, OUSG operates as a “fund of funds,” allocating assets into short-term ETFs and money market funds from BlackRock, Franklin Templeton, and Fidelity, along with a small portion in deposits and USDC to ensure 24/7 liquidity.

By not directly holding or auditing the underlying assets, Ondo avoids operational risks and focuses on the on-chain distribution layer. This approach also lets Ondo leverage the credibility of major TradFi institutions to quickly scale AUM, rather than competing directly as an asset manager.

Sustainable Revenue Model and Token Design

Unlike OUSG, which has minimal fees and is free of charge until 2026 to maximize AUM, USDY is designed to generate revenue directly. The core mechanism is the interest rate spread: Ondo takes all the yield from Treasury bills and bank deposits, then pays USDY holders a slightly lower yield, with the spread becoming a steady and predictable revenue stream.

USDY’s growth has been organic, not driven by marketing or extraordinary yields. In under two years, TVL has grown from about $30 million to nearly $700 million—more than a 14-fold increase. This growth reflects the true nature of cash flows: users choose USDY to preserve value, earn steady yields, and use it as “money,” rather than speculate.

USDY and User Experience Challenges

One complexity with USDY is its 40–50 day lock-up period. During this time, users receive USDYc (“Cooking USDY”), a Temporary Global Certificate recording the amount of USDY to be minted once the lock-up period ends.

While this adds some inconvenience for users, it is necessary to maintain compliance and prevent speculative short-term capital in the early stages of the product.