bitcoin support level, BTC technical analysis, bitcoin price support and resistance, impact on altcoins

As Bitcoin edges ever closer to the pivotal support level around $90,000, anticipation and tension are palpable across the entire cryptocurrency market. Market participants, from novice traders to seasoned institutional investors, are scrutinising every price movement with heightened vigilance. Recent technical analysis of BTC underscores the significance of this price region, highlighting it as a major zone of both support and resistance for Bitcoin. Notably, historical data reveal that such levels often serve as psychological battlegrounds—arenas where bullish buyers and bearish sellers fiercely compete for dominance. Outcomes at these inflection points frequently dictate the direction of the next substantial trend in the broader market.

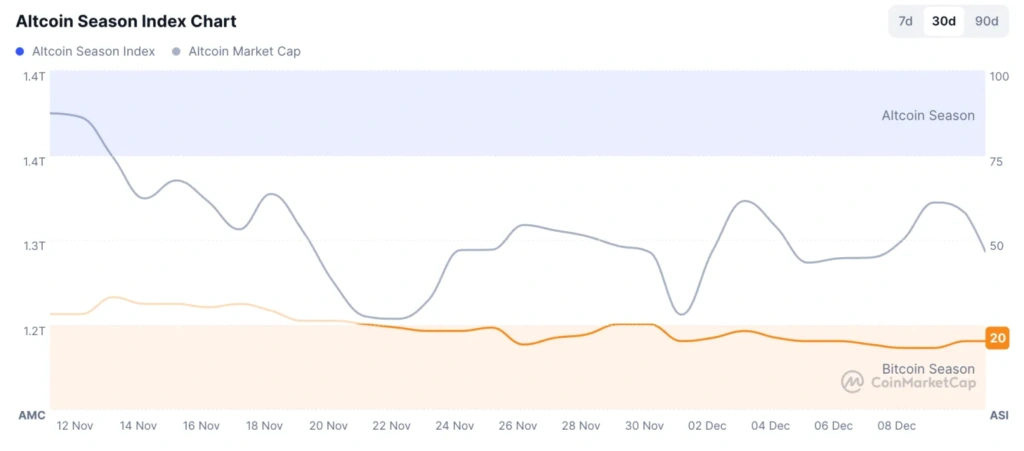

Altcoin Season Index (Source: CoinMarketCap)

Should Bitcoin maintain its position above this critical $90,000 threshold, investors would likely interpret it as a strong vote of confidence. This could ignite a new surge of buying momentum—not only within BTC itself but also spilling over into altcoins. Traditionally, when Bitcoin demonstrates stability or rebounds at notable support levels, investor optimism rises. This renewed sentiment often translates into increased capital inflows towards alternative cryptocurrencies, as traders seek greater returns among promising blockchain projects and emerging tokens.

On the other hand, if Bitcoin fails to defend this vital support and decisively falls below $90,000, it could trigger a cascade of volatility throughout digital asset markets. Such a breach might rapidly erode market sentiment and appetite for riskier assets; panicked selling could ensue across altcoin markets as traders rush to minimise losses amid growing uncertainty.

In conclusion, closely monitoring Bitcoin’s performance near its crucial $90,000 support is not only important for those directly invested in BTC—it is equally consequential for anyone exposed to or trading alternative cryptocurrencies. The outcome at this key juncture will almost certainly play an instrumental role in shaping short- to medium-term price trends across the entire crypto landscape. In times like these, informed vigilance can make all the difference between capitalising on opportunity or being caught off guard by sudden shifts in market direction.